Do you sell overseas ?

The growth of online sales to european consumers from another country has become huge. It is known as ‘distance selling’. International E-commerce is set to grow to over 20% of retail selling in EU within a few years but, be warned, it does bring responsibilities for retailers in terms of understand the VAT laws in each EU state. Failure to do so will leave any online retailer exposed to investigations and potential fines.

What are the distance selling EU VAT rules ?

Businesses selling goods to consumers in other countries will probably face an obligation to charge and collect local consumption taxes. The EU has created a special regime, known as Distance Selling, to simplify the administration and burden and, as far as possible, to encourage free trade in Europe.

The basic rules are as follows:

- Retailers may initially sell to private individuals in other EU states under their local VAT number at their home VAT rate. (For example, a German retailer sells handbags at the German VAT rate of 19% to French customers instead of French VAT rate of 20%)

- Once they pass the respective country’s distance selling annual threshold, they must register as a non-resident VAT trader in the country.

- They then continue to sell, but charge the local VAT. In the example, this would mean the Italian company charging 19% VAT, which is payable to the German tax authorities through a German VAT return.

- once they start submitting a VAT return in another country, they omit those figures from their home country vat return.

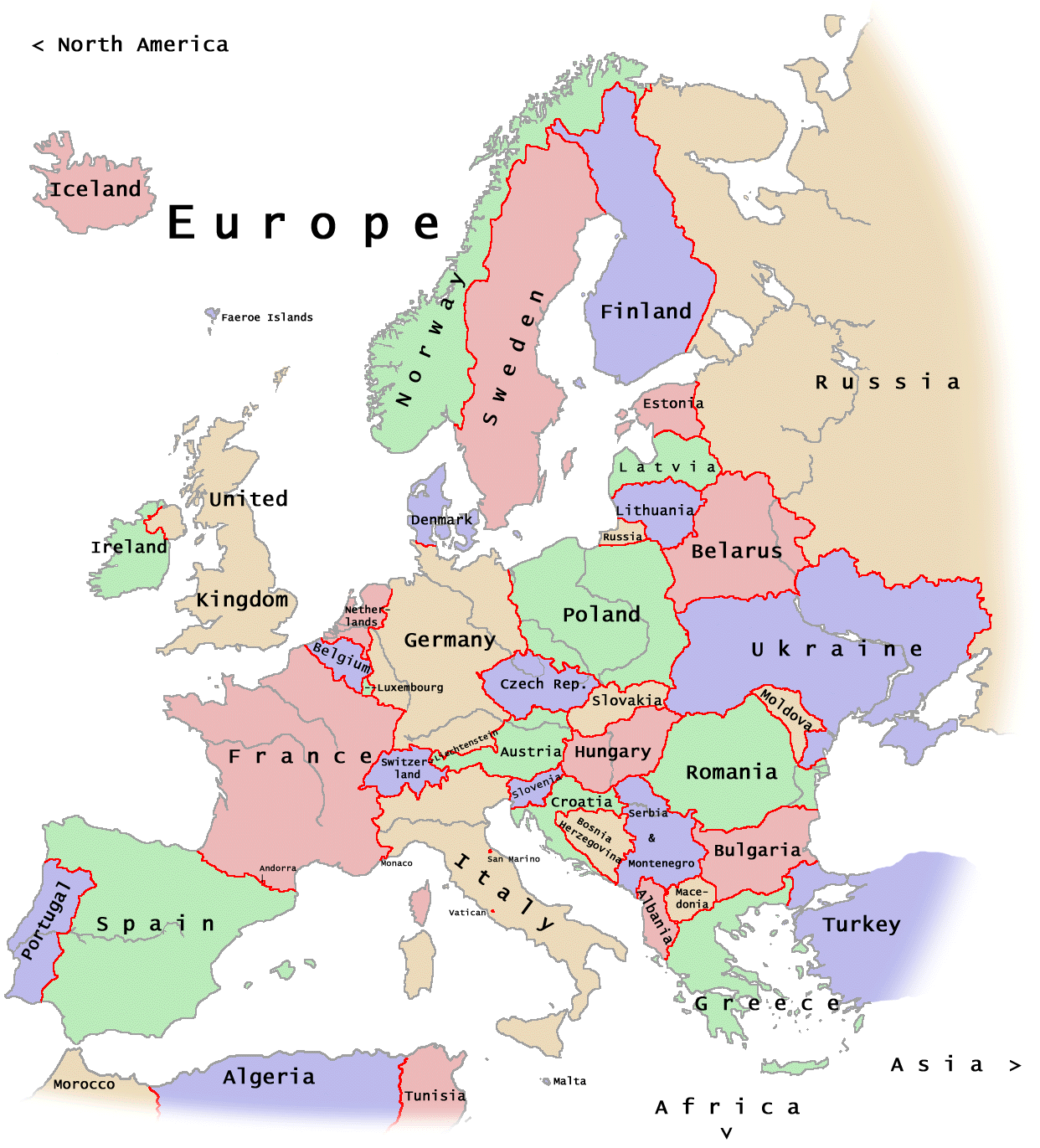

What are the EU distance selling thresholds ? (and their respective standard VAT rates) #

€100,000 per annum - Germany (19%), Luxembourg (17%), Netherlands (21%).

£70,000 - United Kingdom (20%)

Approx €35,000 - Belgium (21%), Denmark (25%), France (20%), Greece (24%), Ireland (23%), Italy (22%) , Poland, Spain (21%), Sweden (25%)

What should I do ?

- If you sell to an EU state, know what the registration limit is to ensure that you register in that country at an appropriate time.

- Know the rate of the country you are selling to; if the rate is higher , that may affect you profitability, if it is lower, you may wish to voluntarily register to increase profit.

- If you need further advice, get in touch.

# These rates and thresholds do change so no responsibilty is taken for using these figures.